There are multiple ways to buy or invest in gold but Sovereign Gold Bonds is the best way. This is because it’s safe, secure, easy to manage, no need to check for impurity and above all you are paid 2.5% interest!

These Sovereign Gold Bonds are open for subscription from time to time and people eligible can invest in them – both online and offline. The advantage of investing online is you get Rs 50 discount over the listed price. For example, the first Series of Sovereign Gold Bonds in FY 2018-19 has the listed price of Rs 3,114 but if you invest online you can get the same at Rs 3,064.

Contents [hide]

Where to Buy Sovereign Gold Bonds?

We list down the entities which are allowed to sell Sovereign Gold Bonds.

Nationalized Banks:

There are 21 nationalised banks which sell gold bonds:

| Allahabad Bank | Corporation Bank | Punjab National Bank |

| Andhra Bank | Dena Bank | State Bank of India |

| Bank of Baroda | IDBI Bank Ltd | Syndicate Bank |

| Bank of India | Indian Bank | UCO Bank |

| Bank of Maharashtra | Indian Overseas Bank | Union Bank of India |

| Canara Bank | Oriental Bank of Commerce | United Bank of India |

| Central Bank of India | Punjab & Sind Bank | Vijaya Bank |

Private Banks:

There are 21 Private banks which sell gold bonds:

| Axis Bank Ltd. | HDFC Bank Ltd. | Kotak Mahindra Bank Ltd. |

| Bandhan Bank | ICICI Bank Ltd. | Lakshmi Vilas Bank Ltd. |

| Catholic Syrian Bank Ltd. | IDFC Bank Ltd. | Nainital Bank Ltd. |

| City Union Bank Ltd. | IndusInd Bank Ltd. | Ratnakar Bank Ltd. |

| Development Credit Bank Ltd. | Jammu & Kashmir Bank Ltd. | South Indian Bank Ltd. |

| Dhanlaxmi Bank Ltd. | Karnataka Bank Ltd. | Tamilnad Mercantile Bank Ltd. |

| Federal Bank Ltd. | Karur Vysya Bank Ltd. | Yes Bank Ltd. |

Also Read: Latest issue of Sovereign Gold Bonds

Foreign Banks:

There are 44 Foreign banks which sell gold bonds:

| Abu Dhabi Commercial Bank Ltd. | Commonwealth Bank of Australia | Oman International Bank |

| American Express Banking Corporation | Credit Agricole Corporate and Investment Bank | Rabobank International |

| Antwerp Diamond Bank N.V | Credit Suisse A.G | Sberbank |

| Arab Bangladesh Bank Ltd.(AB Bank) | DBS Bank Ltd. | Shinhan Bank |

| Australia and New Zealand Banking Group Ltd. | Deutsche Bank | Societe Generale |

| Bank International Indonesia | Doha Bank | Sonali Bank |

| Bank of America | First Rand Bank Ltd. | Standard Chartered Bank |

| Bank of Bahrain & Kuwait B.S.C | Hongkong and Shanghai Banking Corpn. Ltd. | State Bank of Mauritius |

| Bank of Ceylon | Industrial & Commercial Bank of China | Sumitomo Mitsui Banking Corporation |

| Bank of Nova Scotia | J.P.Morgan Chase Bank N.A | The Royal Bank of Scotland N.V |

| Bank of Tokyo – Mitsubishi Ltd. | JSC – VTB Bank | UBS AG |

| Barclays Bank | Krung Thai Bank | United Overseas Bank Ltd. |

| BNP Paribas | Mashreqbank | Westpac Banking Corporation |

| China Trust Bank | Mizuho Corporate Bank Ltd. | Woori Bank |

| Citibank N.A | National Australia Bank |

Post Offices:

Click on the link to download the list of approved post offices for buying gold bonds. There are 810 of them.

Stock Exchanges:

You can invest in Gold bonds through both National Stock Exchange of India Limited and Bombay Stock Exchange Ltd through demat accounts.

Sovereign Gold Bonds Forms:

There are 6 forms related to Sovereign Gold Bonds. You can click on each to download the same.

- Form A – Application Form for Subscription

- Form B – Acknowledgment Receipt

- Form C – Bond Holding Certificate (when applied in physical form). This can be converted to demat form

- Form D – for Nomination

- Form E – for cancellation of nomination

- Form F – Transfer of stock certificate

Buy Sovereign Gold Bonds Online:

You can buy Sovereign Gold Bonds online on most banks through their net-banking or through demat account. We give you examples of buying online through SBI, ICICI Bank and Reliance Securities Demat Account

Also Read: 25 Tax Free Incomes & Investments in India

Buy Sovereign Gold Bonds Online – ICICI Bank:

Follow the following steps:

Step 1: Login to ICICI Net banking

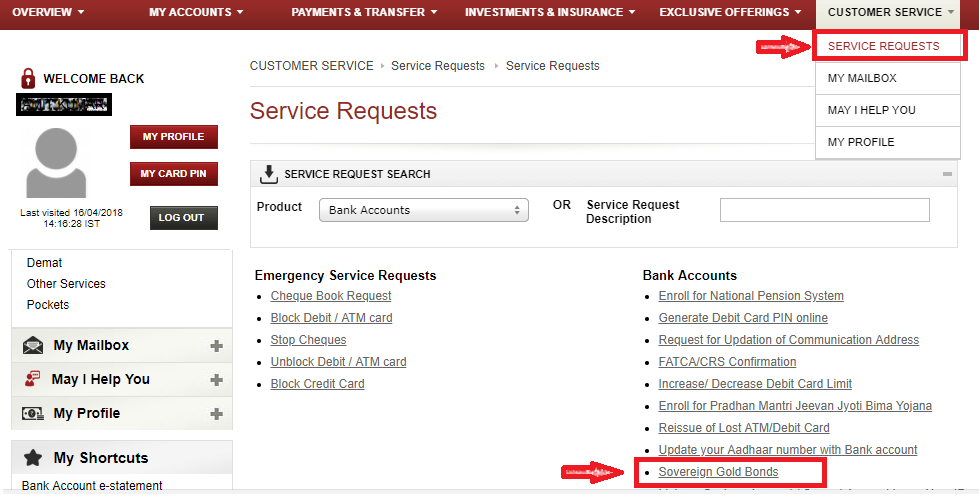

Step 2: Go to Customer Service >> Service Requests

Buy Sovereign Gold Bond Online on ICICI Bank

Step 3: Click on Sovereign Gold Bonds

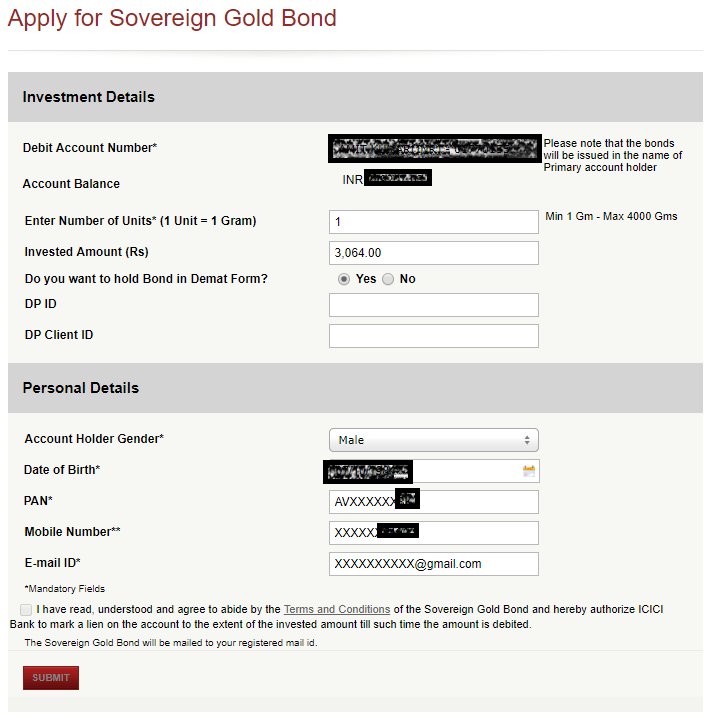

Step 4: Fill the Form

Buy Sovereign Gold Bond Online on ICICI Bank – Form

You are done!

Also Read: 13 Investments to Generate Regular Income

Buy Sovereign Gold Bonds Online – SBI:

Follow the following steps:

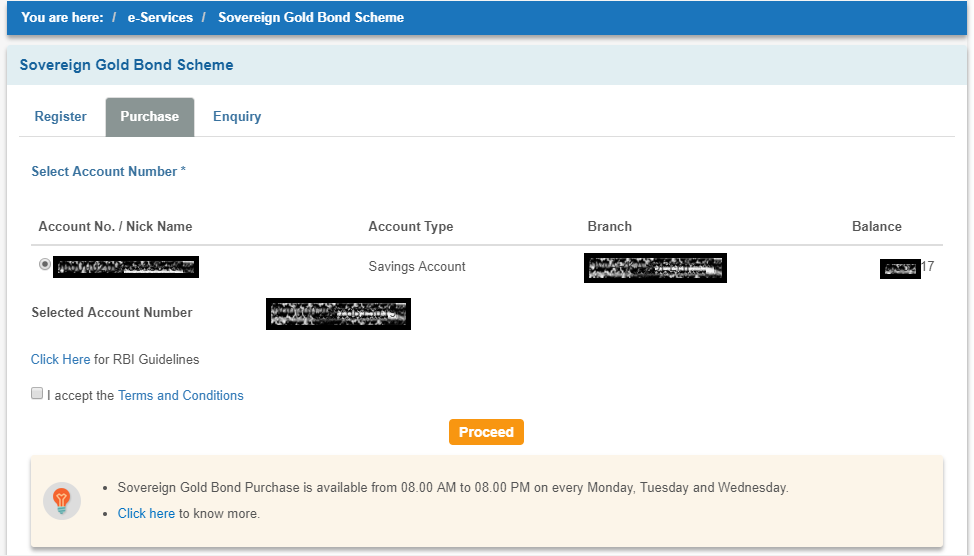

Step 1: Login to SBI Net banking

Step 2: Go to e-Services

Buy Sovereign Gold Bond Online on SBI

Step 3: Click on Sovereign Gold Bonds

Step 4: Fill the Form

SBI Sovereign Gold Bond Online Form

You are done!

Buy Sovereign Gold Bonds Online – Reliance Securities Demat:

Follow the following steps:

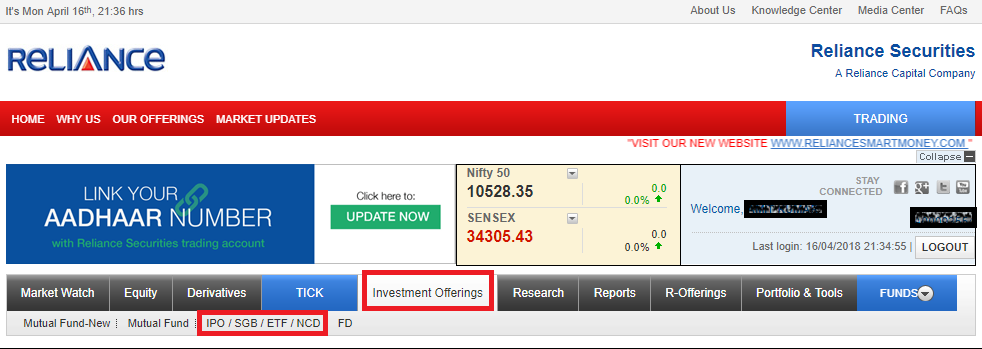

Step 1: Login to Reliance Securities Account

Step 2: Go to Investment Offerings >> IPO/SGB/ETF/NCD

Buy Sovereign Gold Bond Online on Reliance Demat Account

Step 3: Fill the Form by picking Sovereign Gold Bonds Scheme from drop down

Reliance Demat Account Sovereign Gold Bond Online Form

You are done!

To Conclude:

As you can see investing in Sovereign Gold Bonds online through banks (SBI, ICICI, Axis) and demat account is matter of just a few clicks. If you want to buy Sovereign Gold Bonds do it online as it’s not only convenient but also gives you a discount of Rs 50 over the listed price!

0 comments:

Post a Comment